All You Need To Know About Buying in Auburn & Opelika

What’s the current housing market like in Auburn, AL?

Auburn's real estate market is active, especially during spring and summer. Inventory can be tight, but new listings and developments are growing. Whether you’re buying or selling, it’s smart to act strategically with a local expert who knows the trends.

Can you help with student or investment properties near Auburn University?

Do you work with first-time home buyers?

Do I need to get pre-approved before looking at homes?

What are typical closing costs in Alabama?

How long does it take to buy or sell a home?

All You Need To Know About Selling in Auburn & Opelika

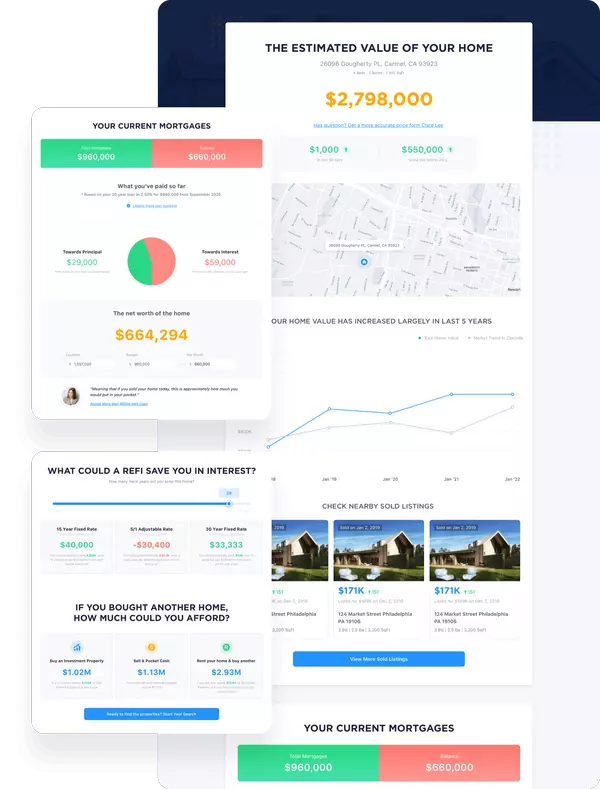

How do I know what my home is worth?

The best way is to request a free home valuation. I’ll review recent comparable sales, your home’s condition, and local market conditions to give you an accurate estimate - not just an online guess.

During our seller's consultation meeting, we will discuss the best strategy for pricing your home. Depending on your priorities, timeline, and final goals, we might have a different plan on where to list your home to help best meet your goal.

For a quick, no-obligation valuation of your home, check out: https://gregsellsauburn.com/evaluation

How long does the home selling process usually take?

What should I do to get my house ready to sell?

Why should I work with you instead of listing or buying on my own?

What types of Marketing are best for selling my home?